How claiming on your private health insurance can affect your discount and what you pay

In this guide, we’ll break down how claiming on your private health insurance policy can affect your no claims discount and what you pay in the future. We'll compare the models of six leading insurers and try to cut through some of the complexities to provide you with clear, actionable insights.

Understanding your health insurance no claims discount

Here's a quick overview of the main things you need to consider about no claims discounts (NCDs) on health insurance policies:

- NCDs in private health insurance policies work differently to other types of insurance, such as motor insurance.

- With most private health insurers, you’ll start with a relatively high discount and move up or down a sliding scale depending on how much you claim.

- Each insurer has its own rules; with variations in the starting discount, the maximum discount, and the claim amount allowed before your NCD is reduced.

- If you don’t make a claim and move up your insurer’s NCD scale, your next renewal price will usually be lower than if you had claimed.

- Pounds and pence savings matter more than percentage discounts - compare the actual costs, not just the percentages.

Related guides:

If you're a driver, you're probably already familiar with no claims discounts (NCDs). They reward you for not making a claim on your insurance. The longer you go without claiming, often, the bigger the discount.

With car insurance, you start with no discount and build it up over time. Every year you have insurance without making a claim, the discount gets bigger – up to a maximum set by your insurer.

Many private health insurance policies also offer NCDs. They work differently, but the effect of making claims is similar – your policy will usually cost more at renewal than if you hadn't.

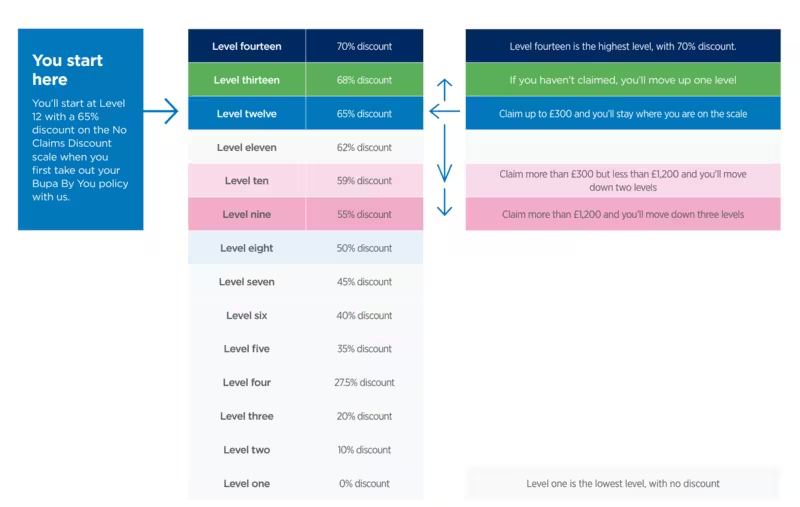

When you get a new private health insurance policy from a provider that offers an NCD, you’ll usually start from day one with a significant discount of up to 72% off the base premium. This is the starkest difference to motor insurance, where you start at 0% and work your way up.

This means health insurance claims can have a big impact on the policy price at renewal - particularly in the early years.

Pretty confusing, right?

As you can see, there's significant variation across insurers - different levels, starting points, percentages and rules. Let's break this down to make it easier to compare.

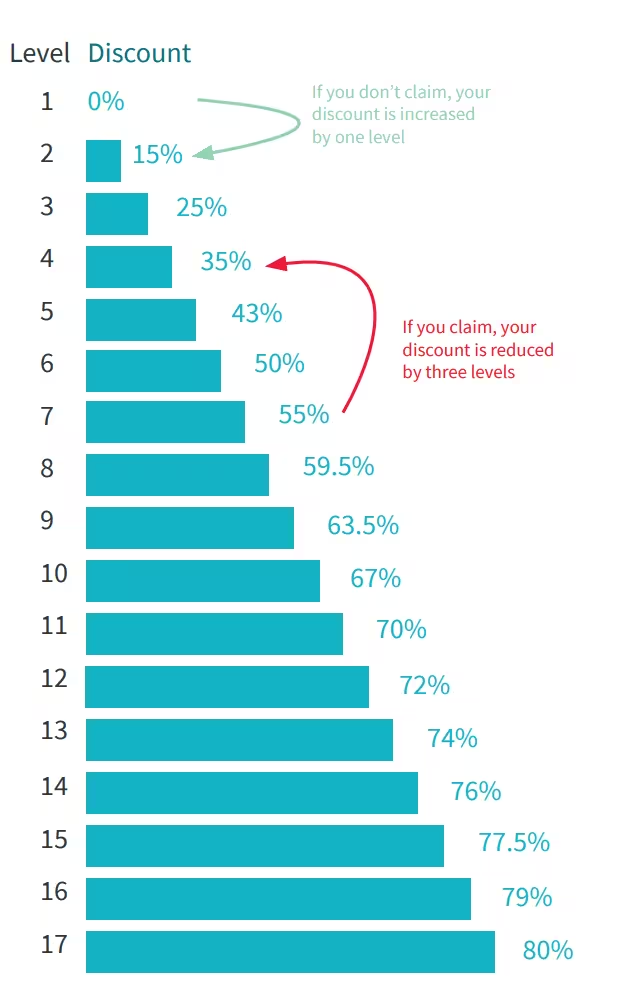

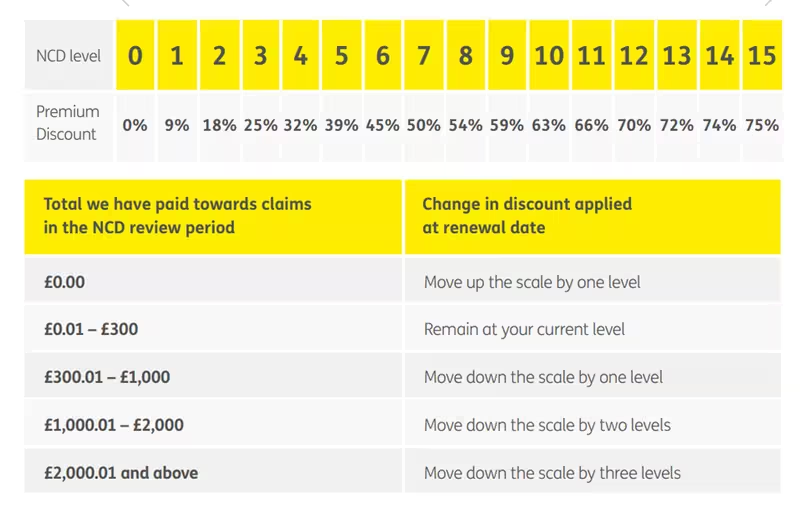

Most private medical insurance plans start around the top of its no claims discount scale, often around level 12 of a possible 14-17 levels.

- No claims in a policy year: You typically move up one level, increasing your discount slightly.

- Making a claim: You may drop multiple levels in one year, depending on the claim size and insurer’s rules.

As you can see from the table, Saga is an exception, as it starts most new policies midway through its discount scale at level five. Although both the starting and maximum discounts are lower than other providers, it doesn’t mean that Saga’s NCD is better. It penalises claims more heavily and the NCD is per policy, not person - more on that later.

It’s not very simple to compare UK health insurance providers' NCDs because they use different scales. Some have more levels than others, and the percentage discounts associated with each level aren’t always the same.

Something all of those that offer an NCD have in common though is that the amount of discount offered between levels gets larger the further down the scale you fall. In other words, you lose a larger percentage of your NCD the more you claim.

How claims of different sizes affect your NCD

Although it’s not easy to compare providers directly, one difference between them is how NCDs are affected by smaller claims.

Saga does things quite differently from the rest

One major provider we haven’t included in the above table is Saga. This is because it doesn’t assess claims based on the total cost in a policy year. Instead, Saga will move you down two levels for every claim you make. So if you make multiple claims in a single policy year, you could lose your NCD much more quickly.

Another key difference with Saga is that its NCD is per policy, not per person as it is with the other providers mentioned in this article. This means all claims have the same impact on the NCD, no matter who makes them.

How Saga’s policy wide NCD compares to other insurers’ per person approach

If you consider a family policy with two adults in their 50s and two teenage children, we’d expect 80-90% of the cost of the policy to be due to the adults on the plan.

With any of the insurers we’ve covered in this article, bar Saga, each family member would have an NCD, so if a child claimed and their discount was affected, or even fully lost, it likely wouldn’t have a huge impact on the overall cost.

By contrast, Saga’s approach of a shared NCD would result in a very different outcome, as the child’s claims would affect the “shared” discount, likely resulting in a significant price rise.

Most private health insurance providers in the UK offer NCDs in some form, but not all of them use a sliding scale. Vitality, for example, uses its own “ABC” model:

- Age

- Base inflation

- Claims

So despite not using a sliding scale, claims are still an important factor that will affect the cost of your policy at renewal.

Some, like Freedom Health Insurance, do not offer an NCD at all. Although it’s likely that your claims history will still be a factor in your renewal price.

Types of claims that won’t affect your no claims discount

Some claims won’t affect your NCD at all. This varies between providers, but generally the following types of claims won’t see you move down any levels on the NCD scale:

- Cash benefits - e.g. dental, optical and NHS

- Remote GP consultations

- Helplines and support services

Another thing to note is that any claims you make below your excess amount won’t affect your NCD. This is because your insurer won’t need to pay out unless your claim exceeds your excess.

Your excess and how it affects your no claims discount

Your excess is the amount you have to contribute towards a claim. For example, if you choose a £500 excess and the cost of your treatment is £2,000, you'll pay £500 and your insurer will pay the rest.

Most insurers let you choose your own excess, and it's directly related to the cost of your policy. If you choose a higher excess, you will pay a lower price for your cover.

This is important because any claim you make under the excess amount won't affect your NCD. Setting a higher excess may make you shoulder more of the initial cost, but it could save you money in the long run. The right choice for you will be an individual one, but it's worth considering when choosing the excess for your policy.

Protecting your no claims discount

Some insurers will give you the option of protecting your NCD. This means you'll pay a bit more for your insurance, but won't lose your discount if you make a claim. Not all providers offer this, but some (e.g. Aviva, AXA Health and The Exeter) do.

If you claim on your health insurance while your NCD is protected, you’ll lose the protection for a period - usually one or two years. If you don’t make another claim in that time, you’ll be able to add NCD protection again.

What our readers say

We are rated Excellent on Google from 150+ reviews. Our reviews relate to the service provided by both myTribe and its partners.

Disclaimer: This information is general, and what is best for you will depend on your personal circumstances. Please speak with a financial adviser or do your own research before making a decision. The brokers we work with provide a comparison service from a panel of some of the UK’s top health insurers. Not every broker works with all the insurers listed in our guides.

Frequently Asked Questions

Does claiming on health insurance affect how much it costs?

Usually, yes. Although how, much difference it makes will depend on who your insurer is and the value of your claim. Some types of claims won't affect the cost of your policy at all.

Which health insurer offers the best no claims discount?

This depends on several factors, including the cost of the policy in pounds and pence and the frequency of your claims. But, The Exeter, WPA and Bupa have some of the most lenient rules around how claims affect your discount level. Some providers offer a higher initial percentage discount, but this may drop relatively quickly compared to others. Some insurers offer lower initial discounts but don't penalise you as heavily for smaller claims.

Does a policy excess protect my no claims discount?

In a way, yes. If your excess is higher than the cost of treatment, you won't lose any of your discount because the insurer doesn't have to pay out. So choosing a higher excess can protect your NCD as well as keeping down the cost of the policy. Some insurers will also allow you to pay for medical treatment yourself to avoid losing your NCD.

Do all members of a family policy share the same no claims discount?

Most - but not all - providers treat people named on a policy as individuals. This means you won't lose your personal NCD if somebody else needs to make a claim, keeping the overall cost of the policy lower.

Does Vitality offer a no claims discount?

Vitality doesn't offer a traditional no claims discount with a sliding scale. It uses its own “ABC” model to set its prices. Claims are still a factor in this and will affect your renewal price.

How does the AXA Health Plan no claims discount work?

The new AXA Health Plan has different NCD rules to AXA Personal Health, with smaller claims moving you fewer levels down the scale. However, AXA Health has not released the percentage discounts associated with these levels, making it difficult to compare directly.